USA Today writer Martha Moore describes this as a "problem", a problem says Moore that's "most acute among minorities: 53% of African-American households and 43% of Hispanic households.

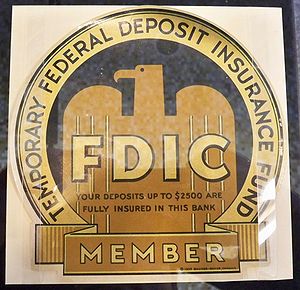

Now the FDIC claims they want banks to "win back those customers, saying consumers should have the benefit of insured savings and be able to build a credit history. Translation -- they need the money.

"There's a substantial segment of American households whose financial services needs aren't being adequately met," Martin Gruenberg, FDIC vice chairman, said in an interview Tuesday. He called the disproportion of minority households in the group "dramatic and troubling."

What's dramatic and troubling is that not only are banks broke, but so is the FDIC, and now they're after money from the poorest segment of the population.

USA Today:

The FDIC will use the data in its effort to persuade more banks to offer starter accounts," low-cost, no-minimum checking accounts without automatic overdraft programs that can result in customers getting hit with fees if they go in the red. One option, Gruenberg said, is to offer incentives to banks through the Community Reinvestment Act, which encourages banks to do business in low- and moderate-income communities."

Some people really can't afford bank accounts. It's too expense when you factor in charges for not meeting minimum deposit requirements, charges for ATM use, overdraft fees that happen because the other fees put you over your balance and you didn't realize it. It says something when people prefer check cashing fees and payday loan charges to bank fees.

ReplyDelete