Do you hear a grinding sound? Listen a little harder. That sound is the brakes being applied to the U.S. economy.

The current price action in commodities markets (as highlighted in my commentary yesterday, “Commodities Growling Like a Bear”) is very much reflective of this braking process. How do we measure the slowing? Where can we gain evidence? Let’s turn to Rick Davis’ fabulous work at Consumer Metrics Institute.

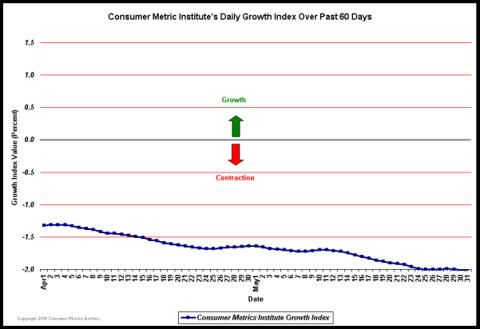

Recall that Rick has not only been way out in front with his calls on the growth of the U.S. economy, but also very accurate especially given that he is projecting GDP a full 4 months prior to its official release. Rick is already on record with his call of -1.5% GDPfor the 2nd quarter 2010. What does Rick see for the 3rd quarter?

May 30, 2010 – BEA Lowers 1st Quarter GDP Estimate as the Consumer Metrics Institute Previews 3rd Quarter GDP:

On May 27th the BEA released its first revision to its 1st Quarter 2010 GDP growth rate measurement, lowering the number from a 3.2% annualized growth rate to 3.0% annualized growth. One day later the Consumer Metrics Institute’s ‘Daily Growth Index’ was signalling what we should expect the BEA’s measurement of the 3rd Quarter 2010 GDP growth rate to be: contracting at about a 2.0% rate.

The prior BEA estimate of 1st Quarter 2010 GDP growth trailed our ‘Daily Growth Index’ by 127 days, and because of the rapid rate that the economy was cooling when the measurements were being made the newly adjusted estimate is now trailing our ‘Daily Growth Index’ by 125 days. Since the 3rd Quarter of 2010 ends 125 days after May 28th (when our ‘Daily Growth Index’ was recording a ‘growth’ rate of -1.99%), if the BEA estimates continue to trail our ‘Daily Growth Index’ in a consistent manner we should expect that the 3rd Quarter’s GDP ‘growth’ rate will be in the -2.0% neighborhood. (Click to enlarge)

Several things were interesting about the BEA announcement, which seems to have been largely ignored by the equity markets on a day when the Dow Industrials were up over 280 points. Not only was the total growth rate revised downward by .2%, but the impact of inventory building was adjusted upward from 1.57% to 1.64%, meaning that the end growth rate of consumer demand (net of inventory build-ups) was dropped from about 1.63% to something closer to 1.36% — a 17% reduction that was hardly worthy of a 280 point rally in the markets. Perhaps the U.S. equity markets should obsess less about Greece and Spain and pay more attention to what is happening with consumers in their own domestic economy.

Since we first reported that our "trailing quarter" had slipped into contraction on January 15th, we have charted how the current 2010 version of the consumer contraction event compares with prior similar events in 2006 and 2008. The current event is significantly different; while it is not as severe as the 2008 contraction, it has already lasted longer without forming a clearly defined bottom. We know that if the GDP mirrors consumer activities (as at least 70% of it should, net of inventory adjustments), both the 2nd and 3rd quarters of 2010 should be contracting at a level of between 1% and 2%. If this isn’t a classic "W" shaped "double dip," it is at least the downward glide of a plane with sputtering engines.

From our perspective the ‘economy’ lives where the consumer spends; everything else is merely the consequence of the downstream flow of commerce from the initial consumer "demand." For this reason the official GDP measurements poorly reflect what is happening in the real-time economy, because they merely capture backward-looking factory production levels far downstream, as augmented by governmental redistribution of earlier tax collections and new public debt. Even John Maynard Keynes would have had to admit that governmental stimulus has to ultimately cause increases in aggregate consumer demand for a real recovery to be happening. We simply aren’t seeing that yet.

What is around the bend as we navigate the economic landscape? A double dip on our economic trail. Thanks to Rick Davis and the Consumer Metrics Institute for his fabulous work.

No comments:

Post a Comment