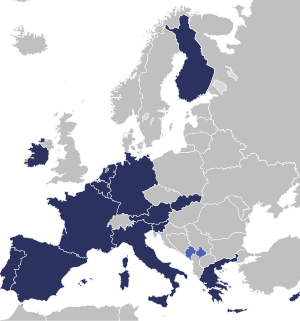

Image via WikipediaThe bailout agreement reached this summer to stop Europe's downward spiral did not even buy time for its sacrosanct August holidays. Within two weeks of the pact, a reluctant European Central Bank was forced to step into the breach and buy Italian and Spanish bonds to counter the market's assault. Leaders had agreed that Europe's bailout fund could buy sovereign bonds in such a situation, but the deal has not yet been ratified by national legislatures, and in any case the bailout fund doesn't have sufficient resources for the job. Inevitably, the focus turns to the country next on the firing line: France, the eurozone's second-largest economy. You can expect the period ahead to oscillate between stagnation and the specter of chaos.

Image via WikipediaThe bailout agreement reached this summer to stop Europe's downward spiral did not even buy time for its sacrosanct August holidays. Within two weeks of the pact, a reluctant European Central Bank was forced to step into the breach and buy Italian and Spanish bonds to counter the market's assault. Leaders had agreed that Europe's bailout fund could buy sovereign bonds in such a situation, but the deal has not yet been ratified by national legislatures, and in any case the bailout fund doesn't have sufficient resources for the job. Inevitably, the focus turns to the country next on the firing line: France, the eurozone's second-largest economy. You can expect the period ahead to oscillate between stagnation and the specter of chaos.What has been lacking so far: action that's a step ahead of the markets. Each European sovereign crisis has had a drawn-out run-up. Time has been wasted defending the indefensible before giving in to the inevitable. In these periods, yields for the majority of European government bonds have increased dramatically without being fully restored after a bailout. That increases the cost of borrowing. Solutions that might have worked a few months earlier become insufficient as the contagion hits more countries. As a consequence, a wider, more expensive response is required. More...

No comments:

Post a Comment