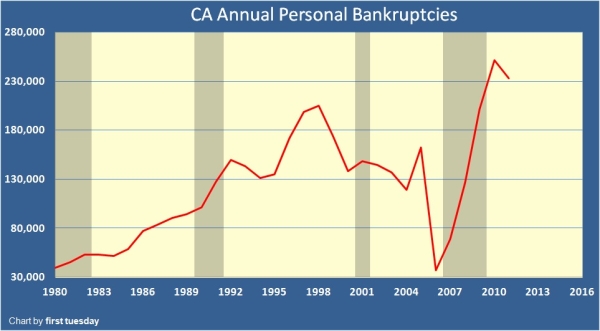

Keep in mind that the falloff in 2006 hit because of the rush to file in 2005 before bankruptcy law became tougher and more difficult to process. We are very much near peak levels under these new stringent requirements. In 2006 we were closer to 35,000 bankruptcy filings while last year we hit 230,000 (an increase of 557%).

What this dramatic change signifies is that the underlying economy is still very weak and many people are unable to meet their current debts. A large part of this is driven by housing debt via mortgages or HELOCs or other forms of debt based spending. Keep in mind over 30 percent of California mortgage holders are currently underwater owing more on their home than it is currently worth. More...

No comments:

Post a Comment