Tuesday, July 2, 2013

Public Approval of Supreme Court Falls to All-Time Low

A new Rasmussen Reports national telephone survey finds that just 28% believe the Supreme Court is doing a good or an excellent job. At the same time, 30% rate its performance as poor. That’s the highest-ever poor rating. It’s also the first time ever that the poor ratings have topped the positive assessments. Thirty-nine percent (39%) give the court middling reviews and rate its performance as fair. (To see survey question wording, click here.)

These numbers are even weaker than the numbers recorded following the Supreme Court ruling upholding the president’s health care law last year. Just before the court heard arguments on the health care law, 28% gave the justices good or excellent marks. However, disapproval was far lower than it is today. Then, following those arguments, many thought the court was likely to overturn the law. At that point, positive ratings for the court shot up to 41%, the highest level in years. However, when the court eventually upheld the health care law, the numbers fell again. Just 29% offered a positive review early that September. Read more >>

Thursday, June 13, 2013

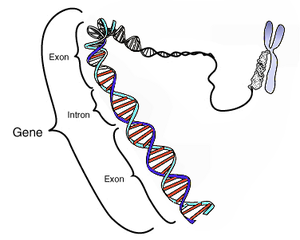

Supreme Court rules human genes cannot be patented

The decision represents a victory for cancer patients, researchers and geneticists who claimed that a single company's patent raised costs, restricted research and sometimes forced women to have breasts or ovaries removed without sufficient facts or second opinions.

But the court held out a lifeline to Myriad Genetics, the company with an exclusive patent on the isolated form of genes that can foretell an increased genetic risk of cancer. The justices said it can patent a type of DNA that goes beyond extracting the genes from the body.

Justice Clarence Thomas wrote the decision for a unanimous court. "Myriad did not create anything," Thomas said. "To be sure, it found an important and useful gene, but separating that gene from its surrounding genetic material is not an act of invention."

The compromise will not stop other scientists from providing genetic diagnostic testing now that the patent on the two genes themselves has been lifted. That should lead to lower costs and greater access. Read more >>

Wednesday, February 20, 2013

U.S. Supreme Court Justices Signal Support for Monsanto on Patents

Hearing arguments today in Washington, a majority of the nine justices suggested that Monsanto has broad rights to control the use of seeds that contain its patented technology. The genetically modified seeds are used to grow more than 90 percent of the nation’s soybeans.

“Why in the world would anybody spend any money to try to improve the seed if as soon as they sold the first one anybody could grow more and have as many of those seeds as they want?” Chief Justice John Roberts said.

He and other justices signaled that they view seeds harvested from patented crops as new products with fresh patent protections. A victory for Monsanto would potentially let patent holders restrict use of self-replicating products beyond the first generation, benefiting producers of live vaccines, genetically modified salmon, and bacteria strains used in medical research. Read more >>

Friday, October 19, 2012

Mobile phones can cause brain tumours, court rules

Innocente Marcolini, 60, an Italian businessman, fell ill after using a handset at work for up to six hours every day for 12 years. Now Italy's Supreme Court in Rome has blamed his phone saying there is a "causal link" between his illness and phone use, the Sun has reported.

Mr Marcolini said: "This is significant for very many people. I wanted this problem to become public because many people still do not know the risks. "I was on the phone, usually the mobile, for at least five or six hours every day at work. "I wanted it recognized that there was a link between my illness and the use of mobile and cordless phones.

"Parents need to know their children are at risk of this illness."

British scientists have claimed there is insufficient evidence to prove any link to mobiles. But the respected oncologist and professor of environmental mutagenesis Angelo Gino Levis gave evidence for Mr Marcolini — along with neurosurgeon Dr Giuseppe Grasso. They said electromagnetic radiation emitted by mobile and cordless phones can damage cells, making tumours more likely. Read more >>

Wednesday, July 11, 2012

Americans' Confidence in Television News Drops to New Low

WASHINGTON, D.C. -- Americans' confidence in television news is at a new low by one percentage point, with 21% of adults expressing a great deal or quite a lot of confidence in it. This marks a decline from 27% last year and from 46% when Gallup started tracking confidence in television news in 1993.

Among 16 U.S. institutions tested, television news ranks 11th, following newspapers in 10th place. The 25% of adults who express a great deal or quite a lot of confidence in newspapers is down slightly from 28% last year. Confidence in newspapers is now half of what it was at its peak of 51% in 1979.

Saturday, June 30, 2012

Obamacare leaves many of the poorest Americans at risk of remaining uninsured

The federal government will pick up the total cost of the expensive expansion for the first three years, after which the funding will phase down to 90%. The expansion could reduce the number of uninsured adults with incomes under 133% of poverty by more than 11 million by 2019, according to a Kaiser Family Foundation estimate.

But here's the catch: The states can opt out of the Medicaid expansion program, since the court said the federal government can't penalize them by withholding all Medicaid funding. Instead, these states wouldn't get the additional Medicaid money to cover newly eligible enrollees. And that could mean trouble for many poor adults who are not eligible for Medicaid under the current system but would have qualified under the expansion. Read more >>

Thursday, June 7, 2012

CBS/New York Times poll: Most want Supreme Court to overturn individual health care mandate

Nearly one-quarter - twenty-four percent - of respondents want the entire law upheld. The margin of error is three percentage points. The percentage that wants to see the entire law abolished is up slightly since April, when 37 percent said they wanted the court to overturn the full law, 29 percent said only the mandate should be overturned and 23 percent wanted the whole law upheld.

As the Supreme Court decision on the health care law is expected this month, the new poll shows that Republicans are much more likely to want the entire law overturned than Democrats, with 67 percent wanting the law to be overturned compared to 20 percent of Democrats. While 42 percent of Democrats say they want the entire law to be upheld, 42 percent of Independent respondents say they want the Supreme Court to overturn the whole law. Tea Party supporters are especially likely to want the entire law to be overturned -- 70 percent support that. Read more >>

Wednesday, July 7, 2010

Iceland Lenders May Lose $4.3 Billion on Court Ruling

Iceland’s lenders may lose as much as $4.3 billion, equivalent to a third of the economy, after a court last month found that some foreign loans were illegal, said Finance Minister Steingrimur J. Sigfusson.

“This is the largest single loan category of the banks, with a value of between 800 billion kronur and 900 billion kronur ($7.2 billion),” Sigfusson said today. “If the capital on all these loans is written down by 40 percent to 60 percent, we’re talking about enormous amounts.”

The Supreme Court ruled June 16 that loans indexed to foreign-currency rates were illegal in three cases involving private car loans and a corporate property loan. The decisions may mean that borrowers with such loans are only obliged to repay the principal in kronur, making the lenders liable for currency losses on about $28 billion in debt after a third of the krona’s value against the Japanese yen and Swiss franc was erased since September 2008.

There’s a “considerable chance” that the ruling will be applied to many foreign-currency indexed loans issued by Icelandic banks, Sigfusson told radio station Bylgjan yesterday. “I’m referring to this not only applying to car loans, but also mortgages, and a considerable amount of loans to companies and other parties.”More...

Saturday, January 23, 2010

Corporate Personhood Should Be Banned, Once and For All

The decision by the U.S. Supreme Court in Citizens United v. Federal Election Commission shreds the fabric of our already

Image via Wikipedia

Image via Wikipedia

This corporatist, anti-voter decision is so extreme that it should galvanize a grassroots effort to enact a Constitutional Amendment to once and for all end corporate personhood and curtail the corrosive impact of big money on politics. It is indeed time for a Constitutional amendment to prevent corporate campaign contributions from commercializing our elections and drowning out the civic and political voices and values of citizens and voters. It is way overdue to overthrow “King Corporation” and restore the sovereignty of “We the People”!

Monday, January 11, 2010

Federal Reserve Seeks to Block Release of U.S. Bailout Secrets

The Federal Reserve will ask a U.S. appeals court to block a ruling that for the first time would force the central bank to reveal secret identities of financial firms that might have collapsed without the largest government bailout in U.S. history.

The U.S. Court of Appeals in Manhattan, after hearing arguments in the case today, will decide whether the Fed must release records of the unprecedented $2 trillion U.S. loan program launched after the 2008 collapse of Lehman Brothers Holdings Inc. In August, a federal judge ordered that the information be released, responding to a request by Bloomberg LP, the parent of Bloomberg News.

Bloomberg argues that the public has the right to know basic information about the “unprecedented and highly controversial use” of public money. Banks and the Fed warn that bailed-out lenders may be hurt if the documents are made public, causing a run or a sell-off by investors. Disclosure may hamstring the Fed’s ability to deal with another crisis, they also argued. The lower court agreed with Bloomberg.

“The question is at what point does the government get so involved in the life of the institution that the public has a right to know?” said Charles Davis, executive director of the National Freedom of Information Coalition at the University of Missouri in Columbia. Davis isn’t involved in the lawsuit.

The ruling by the three-judge appeals panel may not come for months and is unlikely to be the final word. The loser may seek a rehearing or appeal to the full appeals court and eventually petition the U.S. Supreme Court, said Anne Weismann, chief lawyer for Citizens for Responsibility and Ethics, a Washington advocacy group that supports Bloomberg’s lawsuit.

Seeking Disclosure

New York-based Bloomberg, majority-owned by Mayor Michael Bloomberg, sued in November 2008 after the Fed refused to name the firms it lent to or disclose the amounts or assets used as collateral under its lending programs. Most were put in place in response to the deepest financial crisis since the Great Depression.

“Bloomberg has been trying for almost two years to break down a brick wall of secrecy in order to vindicate the public’s right to learn basic information,” Thomas Golden, an attorney for the company with Willkie Farr & Gallagher LLP, wrote in court filings. He said the Fed may be trying “to draw out the proceedings long enough so that the information Bloomberg seeks is no longer of interest.”

The Fed’s balance sheet debt doubled after lending standards were relaxed following Lehman’s failure on Sept. 15, 2008. That year, the Fed began extending credit directly to companies that weren’t banks for the first time since the 1930s. Total central bank lending exceeded $2 trillion for the first time on Nov. 6, 2008, reaching $2.14 trillion on Sept. 23, 2009.

Freedom of Information

The lawsuit, brought under the U.S. Freedom of Information Act, or FOIA, came as President Barack Obama criticized the previous administration’s handling of the $700 billion Troubled Asset Relief Program passed by Congress in October 2008. Obama has said funds were spent by the administration of former President George W. Bush with little accountability or transparency.

FOIA requires federal agencies to make government documents available to the press and public.

In her Aug. 24 ruling, U.S. District Judge Loretta Preska in New York said loan records are covered by FOIA and rejected the Fed’s claim that their disclosure might harm banks and shareholders. An exception to the statute that protects trade secrets and privileged or confidential financial data didn’t apply because there’s no proof banks would suffer, she said.

Burden Not Met

The central bank “speculates on how a borrower might enter a downward spiral of financial instability if its participation in the Federal Reserve lending programs were to be disclosed,” Preska, the chief judge of the Manhattan federal court, said in her 47-page ruling. “Conjecture, without evidence of imminent harm, simply fails to meet the board’s burden” of proof.

In its appeal, the Board of Governors of the Federal Reserve System argued that disclosure of “highly sensitive” documents, including 231 pages of daily lending reports, threatens to stigmatize lenders and cause them “severe and irreparable competitive injury.”

“Confidentiality is essential to the success of the board’s statutory mission to maintain the health of the nation’s financial system and conduct monetary policy,” Assistant U.S. Attorney General Tony West and Fed lawyer Richard Ashton wrote in a legal brief to the appeals court.

“The board’s ability to administer lending programs crucial to maintaining national financial and economic stability will be severely undermined” if lenders won’t come to the regional Federal Reserve Banks “for their funding needs, particularly in time of economic crisis,” they said.

Protected From Disclosure

Historically, the type of government documents sought in the case has been protected from public disclosure because they might reveal competitive trade secrets, Davis said. Laws governing such disclosures may be due for a change, he said, following the far-reaching U.S. bailout.

“If you are in need of a bailout and turn to the federal government and say, ‘help,’ with that comes some requirements in terms of transparency,” Davis said.

The Fed is joined in its bid to overturn Preska’s order by the Clearing House Association LLC, an industry-owned group in New York that processes payments between banks. The group assailed the judge’s decision for what it said were legal errors, such as applying the wrong standard in weighing the exception to FOIA.

The group includes ABN Amro Bank NV, a unit of Royal Bank of Scotland Plc, Bank of America Corp., The Bank of New York Mellon Corp., Citigroup Inc., Deutsche Bank AG, HSBC Holdings Plc, JPMorgan Chase & Co., US Bancorp and Wells Fargo & Co.

Directly Participate

Preska allowed the association to join the case so that it could directly participate in the appeal. More than a dozen other groups or companies filed amicus, or friend-of-the-court, briefs, including the American Society of News Editors and individual news organizations.

The judge postponed the application of her ruling to allow the appeals court to consider the case.

Also today, the same appeals court will hear arguments in a lawsuit brought by News Corp. unit Fox News Network seeking similar documents. U.S. District Judge Alvin Hellerstein in New York sided with the Fed in that case and refused to order the agency to release the documents.

The case is Bloomberg LP v. Board of Governors of the Federal Reserve System, 09-04083, U.S. Court of Appeals for the Second Circuit (New York).

Tuesday, December 8, 2009

The Supreme Case Against Sarbanes-Oxley

The most powerful czar in Washington will receive some long-overdue scrutiny today when the Supreme Court hears a challenge to the constitutionality of the Public Company Accounting Oversight Board (PCAOB).

This board, created by the Sarbanes-Oxley Act of 2002, regulates the auditors of publicly-traded firms. The members are hired by the Securities and Exchange Commission (SEC) and, say the plaintiffs in Free Enterprise Fund v. PCAOB, do not answer to the president. This violates the Constitution's "appointments clause," according to which senior executive-branch officials should be appointed by the president and confirmed by the Senate.

Yet Sarbanes-Oxley, or Sarbox, itself should be subject to scrutiny. New research suggests that the costs of this legislation far outweigh its benefits to the investing public.

If you're wondering whether the members of PCAOB qualify as senior officials, consider that they have regulatory power over every public company in America. Board members fund their activities by collecting taxes, i.e., fees, from public companies based on the size of their assets.

But those fees are just the tip of the iceberg of costs imposed by PCAOB. The board is charged with making sure that Sarbox's Section 404 rules on "internal controls" over bookkeeping are implemented. These rules are so onerous that companies have had to undertake exhaustive investigations of such minor issues as how many people should be required to authorize small customer refunds at a retail location.

In 2003 the SEC estimated that the average company could do much of its internal controls work for $91,000 per year. In 2007, the commission acknowledged costs had gotten out of hand, particularly for smaller companies, and told the PCAOB to make the internal controls audits more cost-effective.

In 2008, the SEC's Office of Economic Analysis launched a survey of public companies to judge the results, and it recently posted the findings on the SEC Web site, after collecting data from thousands of corporations.

Section 404 is still consuming more than $2.3 million each year in direct compliance costs at the average company. The SEC's survey shows the long-term burden on small companies is more than seven times that imposed on large firms relative to their assets. Are the internal controls audits helpful? Among companies of all sizes, only 19% say that the benefits of Section 404 outweigh the costs. More respondents say that it has reduced the efficiency of their operations than say it has improved them. More say that Section 404 has negatively affected the timeliness of their financial reporting than say it has enhanced it.

In the years since its passage, the country has experienced an historic drought of initial public offerings. Is Sarbox to blame? Many financial pundits say no, but the SEC survey results point in the other direction. When public companies are asked whether Section 404 has motivated them to consider going private, a full 70% of smaller firms say yes, and 44% of all public companies also say yes.

Has Sarbox driven businesses out of the country? Among foreign companies, a majority in the survey say that Section 404 has motivated them to consider de-listing from U.S. exchanges, and a staggering 77% of smaller foreign firms say that the law has motivated them to consider abandoning their American listings.

In a separate survey of securities analysts, credit raters and other financial-information consumers, the SEC staff found a more favorable view of section 404, but these consumers admitted they found the "benefits . . . are inherently hard to quantify."

In fact, consumers have already participated in a much more robust and meaningful survey. University of Minnesota economist Ivy Zhang has tracked stock trading during the consideration of Sarbox in 2002 and then during periods when the SEC has considered exempting small companies from the most onerous audits. Comparing U.S.-listed companies to foreign companies free from Sarbox, she finds an increased likelihood of heavier Sarbox regulation is followed immediately by "negative abnormal returns" for U.S. stocks. On the other hand, news of potential relief from the law pushes up American stock prices.

That's not a vote of confidence from the people supposed to benefit from the law. Investors have been skeptical about this political exercise from the beginning. Little surprise that 74% of SEC survey respondents say that Section 404 has had little or no impact on investor confidence in their companies.

More troubling, a new paper in the Journal of Accounting and Economics finds that since the passage of Sarbox, U.S. firms reduced their investments in capital expenditures and research and development compared to firms in the U.K. and Canada. Authors Leonce Bargeron, Kenneth Lehn and Chad Zutter of the University of Pittsburgh count the ways the law discourages innovation: "First, by increasing the role of independent directors in corporate governance and expanding/criminalizing their liability for corporate misdeeds, [Sarbox] discourages directors from approving risky investments that are costly to monitor." The same goes for senior managers.

The authors also note that the SEC "acknowledges that the risk of financial misstatements is directly related to the complexity of a firm's operations, the extent to which it relies on specialized knowledge, and the degree to which its organizational structure is decentralized."

Where these factors are more prevalent, compliance costs will increase. In short, national policy imposes a disproportionate burden on innovative companies that delegate responsibility to highly-trained scientists. Could one devise a more destructive policy for the U.S. economy?

A glimmer of hope lies in the fact that Sarbox, drafted in the political panic following the Enron and Worldcom accounting scandals, failed to include a "severability clause." Thus if PCAOB is struck down as unconstitutional, all of Sarbanes-Oxley could come crashing down with it.

Is all this fuss about board appointments just legal hairsplitting? Sam Kazman, general counsel of the Competitive Enterprise Institute, one of the plaintiffs suing the PCAOB, doesn't think so. He notes that "responsibility for bureaucrats was a fundamental issue for the Framers," and that the appointments clause was created "as an essential check on overweening bureaucracy. As colonists of England, they had seen offices created by both the king and Parliament spawn more offices with no accountability, creating what the Declaration of Independence refers to as a 'multitude of new offices' and 'swarms of officers to harass our people and eat out their substance.'"

Today, people who work at public companies—and their investors—understand this problem perfectly.