This is the first consecutive monthly drop in 14 months and the largest miss vs expectations on record. Printing at 76.8 (against an expectation of 82.0), ths is the lowest in 5 months and points to the picture we have been painting of a consumer increasingly affected by rising rates and saoring gas prices amid stagnant incomes.

As Citi notes below, this is the exact same pattern we have seen play out in the last 2 cycles and suggest significant downside risk to US equities. The economic outlook sub-index collapsed to its lowest since January. Read more >>

Showing posts with label Wall Street. Show all posts

Showing posts with label Wall Street. Show all posts

Friday, September 13, 2013

Friday, August 23, 2013

Elizabeth Warren Reads Riot Act to Holder for Not Prosecuting Big Bank Mortgage Fraud

Okay, so Senator Warren actually wrote a polite, detailed letter to Attorney General Holder. There was no shouting or acrimony.

However, in Washington, for a freshman senator to imply in official correspondence made public that the Department of Justice is not doing its job in investigating, prosecuting and even fining banks and secondary lenders in regards to multiple counts of mortgage lending violations is akin to a freshman at high school accusing the principal of letting teachers steal milk money from the desks of students.

It may be professional in tone, but Warren's letter is a direct challenge to the criminal impunity provided to and limited fines assessed by the DOJ on Wall Street for their multiple schemes to defraud both mortgage borrowers and investors.

The Huffington Post featured the letter, which bluntly states:

I am concerned that this might be yet another example of the federal government's timid enforcement strategy against the nation's largest financial institutions. I believe that if DOJ and our banking regulatory agencies prove unwilling over time to take the big banks to trial or even require admission of guilt when they cheat consumers and break the law -- either out of timidity or because of a lack of resources -- then the agencies lose enormous leverage in settlement negotiations.

There are a number of federal agencies involved in the lax regulation and minimal punishment (no jail time) of the financial industry for its role, particularly in the creation of a toxic subprime mortgage scam, in the economic collapse that burst open in the autumn of 2007. Read more >>

However, in Washington, for a freshman senator to imply in official correspondence made public that the Department of Justice is not doing its job in investigating, prosecuting and even fining banks and secondary lenders in regards to multiple counts of mortgage lending violations is akin to a freshman at high school accusing the principal of letting teachers steal milk money from the desks of students.

It may be professional in tone, but Warren's letter is a direct challenge to the criminal impunity provided to and limited fines assessed by the DOJ on Wall Street for their multiple schemes to defraud both mortgage borrowers and investors.

The Huffington Post featured the letter, which bluntly states:

I am concerned that this might be yet another example of the federal government's timid enforcement strategy against the nation's largest financial institutions. I believe that if DOJ and our banking regulatory agencies prove unwilling over time to take the big banks to trial or even require admission of guilt when they cheat consumers and break the law -- either out of timidity or because of a lack of resources -- then the agencies lose enormous leverage in settlement negotiations.

There are a number of federal agencies involved in the lax regulation and minimal punishment (no jail time) of the financial industry for its role, particularly in the creation of a toxic subprime mortgage scam, in the economic collapse that burst open in the autumn of 2007. Read more >>

Wednesday, August 7, 2013

U.S. accuses Bank of America of mortgage-backed securities fraud

The lawsuits are the latest legal headache for the second-largest U.S. bank, which has already agreed to pay in excess of $45 billion to settle disputes stemming from the 2008 financial crisis.

While most of the cases Bank of America has already confronted pertain to its acquisitions of brokerage Merrill Lynch and home lender Countrywide, the lawsuits filed on Tuesday pertain to mortgages the government said were originated, securitized and sold by Bank of America's legacy businesses.

The residential mortgage-backed securities at issue, known as RMBS, were of a higher credit quality than subprime mortgage bonds and date to about January 2008, the government said, months after many Wall Street banks first reported billions of dollars in write-downs on their holdings of subprime mortgage securities. Read more >>

Wednesday, July 24, 2013

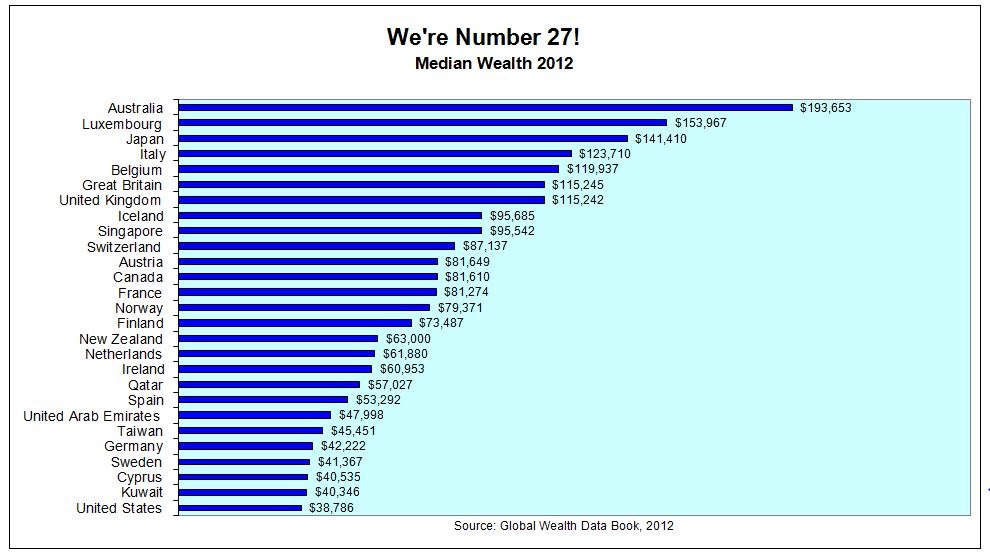

America’s Middle Class Ranks #27 on Global Scale

America is the richest country on Earth. We have the most millionaires, the most billionaires and our wealthiest citizens have garnered more of the planet’s riches than any other group in the world. We even have hedge fund managers who make in one hour as much as the average family makes in 21 years!

This opulence is supposed to trickle down to the rest of us, improving the lives of everyday Americans. At least that’s what free-market cheerleaders repeatedly promise us.

Unfortunately, it’s a lie, one of the biggest ever perpetrated on the American people.

Our middle class is falling further and further behind in comparison to the rest of the world. We keep hearing that America is number one. Well, when it comes to middle-class wealth, we’re number 27.

The most telling comparative measurement is median wealth (per adult). It describes the amount of wealth accumulated by the person precisely in the middle of the wealth distribution — fifty percent of the adult population has more wealth, while fifty percent has less. You can’t get more middle than that. Read more >>

Labels:

Business,

Earth,

Free market,

Investing,

Middle class,

United States,

Wall Street,

Wealth

Tuesday, June 25, 2013

U.S. Civil Charges Against Corzine pending BUT NO CRIMINAL CHARGES!

Federal regulators are poised to sue Jon S. Corzine over the collapse of MF Global and the brokerage firm’s misuse of customer money during its final days, a blowup that rattled Wall Street and cast a spotlight on Mr. Corzine, the former New Jersey governor who ran the firm until its bankruptcy in 2011.

The Commodity Futures Trading Commission, the federal agency that regulated MF Global, plans to approve the lawsuit as soon as this week, according to law enforcement officials with knowledge of the case. In a rare move against a Wall Street executive, the agency has informed Mr. Corzine’s lawyers that it aims to file the civil case without offering him the opportunity to settle, setting up a legal battle that could drag on for years.

Without directly linking Mr. Corzine to the disappearance of more than $1 billion in customer money, the trading commission will probably blame the chief executive for failing to prevent the breach at a lower rung of the firm, the law enforcement officials said. If found liable, he could face millions of dollars in fines and possibly a ban from trading commodities, jeopardizing his future on Wall Street. Read more >>

Wednesday, May 15, 2013

10 Scenes From The Ongoing Global Economic Collapse Sweeping Across The Planet

|

| A simulated-color satellite image of Metro Detroit, with Windsor across the river, taken on NASA's Landsat 7 satellite. (Photo credit: Wikipedia) |

When is the economic collapse going to happen? Just open up your eyes and take a look around the globe. The next wave of the economic collapse may not have reached Wall Street yet, but it is already deeply affecting billions of lives all over the planet.

Much of Europe has already descended into a deep economic depression, very disturbing economic data is coming out of the second and third largest economies on the globe (China and Japan), and in most of the world economic inequality is growing even though 80 percent of the global population already lives on less than $10 a day.

Just because the Dow has been setting brand new all-time records lately does not mean that everything is okay. Remember, a bubble is always the biggest right before it bursts. The next major wave of the economic collapse is already sweeping across Europe and Asia and it is going to devastate the United States as well. I hope that you are ready.

The following are 10 scenes from the economic collapse that is sweeping across the planet:

#1 27 Percent Unemployment/60 Percent Youth Unemployment In Greece

The economic depression in Europe just continues to get worse with each passing month. According to the Daily Mail, the unemployment rate in Greece has nearly tripled since 2009...

Greek youth unemployment rose above 60 per cent for the first time in February, reflecting the pain caused by the country's crippling recession after years of austerity under its international bailout.

Greece's jobless rate has almost tripled since the country's debt crisis emerged in 2009 and was more than twice the euro zone's average unemployment reading of 12.1 percent in March.

While the overall unemployment rate rose to 27 per cent, according to statistics service data released on Thursday, joblessness among those aged between 15 and 24 jumped to 64.2 percent in February from 59.3 percent in January.

#2 Detroit, Michigan Is Insolvent And Is Rapidly Running Out Of Cash

I love to write about Detroit because it is a perfect example of where the rest of the country is headed. They have just gotten there first. At this point, Detroit is essentially bankrupt, and the new emergency financial manager is saying that Detroit may totally run out of cash next month...

Detroit may run out of cash next month and must cut long-term debt and retiree obligations, according to emergency financial manager Kevyn Orr’s preliminary plan to save Michigan’s largest city from bankruptcy.

Orr’s report says the cost of $9.4 billion in bond, pension and other long-term liabilities is sapping the ability to provide public safety and transportation. He listed cutting debt principal, retiree benefits and jobs among his options.

“No one should underestimate the severity of the financial crisis,” Orr said yesterday in a statement. He called his report “a sobering wake-up call about the dire financial straits the city of Detroit faces.”

#3 Economic Despair In France

France is going down the same path that Greece, Spain, Portugal and Italy have gone. The following is an excerpt from a recent article in the Economist...

HELDER PEREIRA is a young man with no work and few prospects: a 21-year-old who failed to graduate from high school and lost his job on a building site four months ago. With his savings about to run out, he has come to his local employment centre in the Paris suburb of Sevran to sign on for benefits and to get help finding something to do. He’ll get the cash. Work is another matter. Youth unemployment in Sevran is over 40%. Read more >>

Labels:

Daily Mail,

Detroit,

Economic collapse,

Greece,

Sevran,

Spain,

United States,

Wall Street

Monday, January 7, 2013

Secret and Lies of the Bailout

The federal rescue of Wall Street didn’t fix the economy – it created a permanent bailout state based on a Ponzi-like confidence scheme. And the worst may be yet to come

Matt Taibbi

It has been four long winters since the federal government, in the hulking, shaven-skulled, Alien Nation-esque form of then-Treasury Secretary Hank Paulson, committed $700 billion in taxpayer money to rescue Wall Street from its own chicanery and greed. To listen to the bankers and their allies in Washington tell it, you'd think the bailout was the best thing to hit the American economy since the invention of the assembly line. Not only did it prevent another Great Depression, we've been told, but the money has all been paid back, and the government even made a profit. No harm, no foul – right?

Wrong.

It was all a lie – one of the biggest and most elaborate falsehoods ever sold to the American people. We were told that the taxpayer was stepping in – only temporarily, mind you – to prop up the economy and save the world from financial catastrophe. What we actually ended up doing was the exact opposite: committing American taxpayers to permanent, blind support of an ungovernable, unregulatable, hyperconcentrated new financial system that exacerbates the greed and inequality that caused the crash, and forces Wall Street banks like Goldman Sachs and Citigroup to increase risk rather than reduce it. The result is one of those deals where one wrong decision early on blossoms into a lush nightmare of unintended consequences. We thought we were just letting a friend crash at the house for a few days; we ended up with a family of hillbillies who moved in forever, sleeping nine to a bed and building a meth lab on the front lawn.

But the most appalling part is the lying. The public has been lied to so shamelessly and so often in the course of the past four years that the failure to tell the truth to the general populace has become a kind of baked-in, official feature of the financial rescue. Money wasn't the only thing the government gave Wall Street – it also conferred the right to hide the truth from the rest of us. And it was all done in the name of helping regular people and creating jobs. "It is," says former bailout Inspector General Neil Barofsky, "the ultimate bait-and-switch."

The bailout deceptions came early, late and in between. There were lies told in the first moments of their inception, and others still being told four years later. The lies, in fact, were the most important mechanisms of the bailout. The only reason investors haven't run screaming from an obviously corrupt financial marketplace is because the government has gone to such extraordinary lengths to sell the narrative that the problems of 2008 have been fixed. Investors may not actually believe the lie, but they are impressed by how totally committed the government has been, from the very beginning, to selling it. Read more >>

Matt Taibbi

It has been four long winters since the federal government, in the hulking, shaven-skulled, Alien Nation-esque form of then-Treasury Secretary Hank Paulson, committed $700 billion in taxpayer money to rescue Wall Street from its own chicanery and greed. To listen to the bankers and their allies in Washington tell it, you'd think the bailout was the best thing to hit the American economy since the invention of the assembly line. Not only did it prevent another Great Depression, we've been told, but the money has all been paid back, and the government even made a profit. No harm, no foul – right?

Wrong.

It was all a lie – one of the biggest and most elaborate falsehoods ever sold to the American people. We were told that the taxpayer was stepping in – only temporarily, mind you – to prop up the economy and save the world from financial catastrophe. What we actually ended up doing was the exact opposite: committing American taxpayers to permanent, blind support of an ungovernable, unregulatable, hyperconcentrated new financial system that exacerbates the greed and inequality that caused the crash, and forces Wall Street banks like Goldman Sachs and Citigroup to increase risk rather than reduce it. The result is one of those deals where one wrong decision early on blossoms into a lush nightmare of unintended consequences. We thought we were just letting a friend crash at the house for a few days; we ended up with a family of hillbillies who moved in forever, sleeping nine to a bed and building a meth lab on the front lawn.

But the most appalling part is the lying. The public has been lied to so shamelessly and so often in the course of the past four years that the failure to tell the truth to the general populace has become a kind of baked-in, official feature of the financial rescue. Money wasn't the only thing the government gave Wall Street – it also conferred the right to hide the truth from the rest of us. And it was all done in the name of helping regular people and creating jobs. "It is," says former bailout Inspector General Neil Barofsky, "the ultimate bait-and-switch."

The bailout deceptions came early, late and in between. There were lies told in the first moments of their inception, and others still being told four years later. The lies, in fact, were the most important mechanisms of the bailout. The only reason investors haven't run screaming from an obviously corrupt financial marketplace is because the government has gone to such extraordinary lengths to sell the narrative that the problems of 2008 have been fixed. Investors may not actually believe the lie, but they are impressed by how totally committed the government has been, from the very beginning, to selling it. Read more >>

Monday, November 19, 2012

The Fed has created the largest Ponzi Scheme in history

|

| The Federal Reserve: The Biggest Scam In History (Photo credit: CityGypsy11) |

Mitch Feierstein, Author, 'Planet Ponzi'

Loose money in the past, loose money guaranteed into the future ... but that's still not enough. The Fed has enlarged its balance sheet by $2 trillion since the crisis began to unfold. But that doesn't even say it. The unelected officials at the Fed handed out an extraordinary $16 trillion in secret loans to bail out banks and businesses in the 2008-10 period. Those loans were not known to, or authorized by, Congress and many of the recipients were firms owned and headquarter abroad. Sen. Bernie Sanders, who has much to call attention to these issues, comments, 'No agency of the United States government should be allowed to bailout a foreign bank or corporation without the direct approval of Congress and the president.' Well, duh! It's frankly extraordinary that there should be any question about this.

As Sanders also points out, the actual operation of the bailouts was largely outsourced in large part to investment banking firms on Wall Street who benefitted directly from the bailout. According to the Government Accountability Office, some two-thirds of such outsourcing contracts were awarded on a no-bid basis, an extraordinary failure. And meantime in a 'money-laundering' style operation, the Fed is acquiring $40 billion of low-quality mortgage backed securities - in many cases from the firms that created and missold them - thereby cleaning corrupt balance sheets at the risk of the US taxpayer.

The problems created by this unconstitutional misconduct go far beyond the mere trillions of dollars involved. The US Treasury market is being currently manipulated on a heroic scale. At times we've seen the Fed buying as much as 70% of US government bond issuance. Worse still, it's effectively told the market that it intends to continue supporting the market as much as necessary for as long as necessary. In effect, we have a tiny group of unelected officials pursuing a set of radical and experimental policies - QE infinity, money-printing, unlimited bond buying, call it what you will.

And the theory behind this activity is simply crazy. When have price controls and state intervention ever worked? I don't just mean for the US Treasuries market, but for any major market at any time? State intervention always fails. The Fed is simply setting up what looks set to be the largest Ponzi Scheme in history. Read more >>

Tuesday, September 25, 2012

More Bank Layoffs Coming: 'Bad as I've Seen It': Whitney

Banks have been behind the curve in terms of downsizing, with their employees paying for it now through a rash of furloughs, analyst Meredith Whitney told CNBC.

The industry has seen a recent spate of big layoff announcements, including 16,000 from Bank of America alone. Though banks already have jettisoned about half a million workers since the beginning of the financial crisis in 2008, Whitney said more are to come as the shrinking big institutions struggle to compete.

"The banks have been overstaffed for a really long time. If you think about all of the other industries that have gotten more competitive, more profitable, the banking sector and the insurance sector have been laggards behind it, and they employ a lot of people," Whitney said on "Closing Bell."

New banking regulations, particularly the Dodd-Frank financial reform bill, have seen the banks shrinking in order to avoid the too-big-to-fail syndrome that caused the industry to push the country into recession. Read more >>

Labels:

Bank,

Bank of America,

CNBC,

JPMorgan Chase,

Layoff,

Meredith Whitney,

Wall Street,

Whitney

Friday, September 21, 2012

Olive Garden, Red Lobster sales struggle

Darden Restaurants Inc. said Friday that its fiscal first-quarter net income rose 4 percent even as it struggled to grow a key revenue figure at its flagship Olive Garden and Red Lobster chains.

Its earnings beat Wall Street expectations, and its shares rose more than 4 percent in premarket trading. At Olive Garden, the company’s biggest chain, Darden has been trying to increase sales by retooling its marketing message and updating its menu. Although traffic at established restaurants declined during the quarter, the company said a key sales figure edged up 0.3 percent on higher prices.

At Red Lobster, sales at restaurants open at least a year fell 2.6 percent as traffic declined. The sales metric is a key indicator of health because it strips out the impact of newly opened and closed locations. Read more >>

Friday, September 7, 2012

How the Big Banks Are Trying to Destroy Our Justice System

Brad Karp, a partner at the 737-attorney-strong Wall Street law firm, Paul, Weiss, Rifkind, Wharton & Garrison LLP, has been Citigroup’s go-to guy for fraud allegations since the company was born out of the too-big-too-fail merger of Travelers Group insurance, its myriad Wall Street investment banks, brokerage units, and Citicorp, parent of Citibank.

When the London-based private equity firm, Terra Firma, claimed it had been lied to and defrauded by Citigroup, making it overpay for the purchase of EMI, a British music label, in 2007, Karp and colleagues wrung an 8-0 decision from the jury in favor of Citigroup. Karp was also on hand to witness victory when the trustee for the bankrupt Italian dairy giant, Parmalat, charged Citigroup with fraud. Then there were fraud charges connected to Citigroup’s involvement in the collapse of WorldCom AND Enron – along with auction rate securities, rigged stock research and understating its exposure to subprime debt by $39 billion. Karp, Karp, and more Karp. Read more >>

Tuesday, August 14, 2012

Chinese companies pull out of U.S. stock markets

Just a few years after Chinese companies lined up to sell shares on Wall Street, a growing number are reversing course and pulling out of their U.S. stock exchange listing.

This week, Focus Media Holding, announced its chairman and private equity firm investors want to buy back its U.S.-traded shares and take the Shanghai-based advertising company private. The deal would value Focus Media at $3.5 billion, according to financial information firm Dealogic.

Some Chinese companies say they are pulling out of U.S. markets because a low share price fails to reflect the strength of their business. Withdrawing also eliminates the cost of complying with American financial reporting rules.

The withdrawals follow accusations of improper accounting by some companies and a deadlock between Beijing and Washington over whether U.S. regulators can oversee their China-based auditors.

Washington wants auditors to hand over documentation on companies that are under investigation but Chinese authorities have barred the release of some information. If a settlement is not reached, the SEC could reject audits by China-based firms, forcing companies to find new auditors. Read more >>

This week, Focus Media Holding, announced its chairman and private equity firm investors want to buy back its U.S.-traded shares and take the Shanghai-based advertising company private. The deal would value Focus Media at $3.5 billion, according to financial information firm Dealogic.

Some Chinese companies say they are pulling out of U.S. markets because a low share price fails to reflect the strength of their business. Withdrawing also eliminates the cost of complying with American financial reporting rules.

The withdrawals follow accusations of improper accounting by some companies and a deadlock between Beijing and Washington over whether U.S. regulators can oversee their China-based auditors.

Washington wants auditors to hand over documentation on companies that are under investigation but Chinese authorities have barred the release of some information. If a settlement is not reached, the SEC could reject audits by China-based firms, forcing companies to find new auditors. Read more >>

Tuesday, August 7, 2012

Cronyism, political donations likely behind Obama, Holder failure to charge any bankers

Daily Caller

A new report from the conservative Government Accountability Institute (GAI) finds that President Barack Obama’s and Attorney General Eric Holder’s failure to criminally charge any top Wall Street bankers is likely a result of cronyism inside the Department of Justice and political donations made to Obama’s campaign.

Wednesday, August 1, 2012

The Real Crash is dead ahead as 2008 is forgotten

“Facebook will become the poster child for the current social-media bubble,” warns economist Gary Shilling in his latest Forbes column, “just as Pets.com was for the dot-com bubble.” Yes, Wall Street is repeating the 2000 dot-com crash as today’s social-media bubble crashes and burns.

Think history folks: Remember 2000-2002? The economy suffered a 30-month recession and a brutal bear market. The Dow Jones Industrial Average peaked at 11,722, then crashed, losing over 4,000 points dropping below 7,500, down more than 43%, with massive losses of more than $8 trillion in market cap.

But it gets worse: Shilling’s bluntly warning: “If we aren’t already in a recession, we’re getting very close.” Yes, he’s more reserved than Nobel economist Paul Krugman, whose latest book goes beyond hinting that the America economy is repeating the 2000-2002 recession, His title says it all: “End This Depression Now!”

But the scariest fact is that America’s warring politicians, CEOs and Super Rich can’t even see the obvious link between the 2012 social-media bubble and the 2008 Wall Street credit bubble that nearly bankrupt our monetary system and forced Congress and the Fed into bailing out our too-big-to-manage banks to an estimated $29.7 trillion in cash, credits, cheap money loans and debt relief. Read more >>

Think history folks: Remember 2000-2002? The economy suffered a 30-month recession and a brutal bear market. The Dow Jones Industrial Average peaked at 11,722, then crashed, losing over 4,000 points dropping below 7,500, down more than 43%, with massive losses of more than $8 trillion in market cap.

But it gets worse: Shilling’s bluntly warning: “If we aren’t already in a recession, we’re getting very close.” Yes, he’s more reserved than Nobel economist Paul Krugman, whose latest book goes beyond hinting that the America economy is repeating the 2000-2002 recession, His title says it all: “End This Depression Now!”

But the scariest fact is that America’s warring politicians, CEOs and Super Rich can’t even see the obvious link between the 2012 social-media bubble and the 2008 Wall Street credit bubble that nearly bankrupt our monetary system and forced Congress and the Fed into bailing out our too-big-to-manage banks to an estimated $29.7 trillion in cash, credits, cheap money loans and debt relief. Read more >>

Monday, July 23, 2012

HSBC Scandal: Rampant Drug Money Laundering, Deals With Iran

"And remember, where you have a concentration of power in a few hands, all too frequently men with the mentality of gangsters get control. History has proven that."

John Dalberg Lord Acton

This HSBC scandal is being overshadowed by LIBOR a bit in the States at least, and the usual diversions of the day to day, but it seems about to explode into the headlines of the insular major media.

There is chatter in banking circles that HSBC is about to be handed a record fine of one billion dollars, or more. At least this is what I hear. Obama will point to it as a 'get tough' approach to the rampant fraud and bad behaviour that is still plaguing the US recovery and financial system.

The US has been looking to make an example that whilst some banking excesses might be tolerated, there are areas of dirty financial dealing that go a step too far and will be dealt with. Especially if the perpetrator is not in the official stable of monetary mavens. The august Senators are still chafing at having to kowtow publicly to some of the pampered princes of Wall Street, whose deep pockets fill their campaign coffers. Read more >>

John Dalberg Lord Acton

This HSBC scandal is being overshadowed by LIBOR a bit in the States at least, and the usual diversions of the day to day, but it seems about to explode into the headlines of the insular major media.

There is chatter in banking circles that HSBC is about to be handed a record fine of one billion dollars, or more. At least this is what I hear. Obama will point to it as a 'get tough' approach to the rampant fraud and bad behaviour that is still plaguing the US recovery and financial system.

The US has been looking to make an example that whilst some banking excesses might be tolerated, there are areas of dirty financial dealing that go a step too far and will be dealt with. Especially if the perpetrator is not in the official stable of monetary mavens. The august Senators are still chafing at having to kowtow publicly to some of the pampered princes of Wall Street, whose deep pockets fill their campaign coffers. Read more >>

Thursday, July 12, 2012

New reporter? Call him Al, for algorithm - the next generation of content creation

The new reporter on the US media scene takes no coffee breaks, churns

out articles at lightning speed, and has no pension plan. That's because

the reporter is not a person, but a computer algorithm, honed to

translate raw data such as corporate earnings reports and previews or

sports statistics into readable prose.

Algorithms are producing a growing number of articles for newspapers and websites, such as this one produced by Narrative Science: "Wall Street is high on Wells Fargo, expecting it to report earnings that are up 15.7 percent from a year ago when it reports its second quarter earnings on Friday, July 13, 2012," said the article on Forbes.com. While computers cannot parse the subtleties of each story, they can take vast amounts of raw data and turn it into what passes for news, analysts say.

"This can work for anything that is basic and formulaic," says Ken Doctor, an analyst with the media research firm Outsell. And with media companies under intense financial pressure, the move to automate some news production "does speak directly to the rebuilding of the cost economics of journalism," said Doctor. Stephen Doig, a journalism professor at Arizona State University who has used computer systems to sift through data which is then provided to reporters, said the new computer-generated writing is a logical next step. Read more >>

Algorithms are producing a growing number of articles for newspapers and websites, such as this one produced by Narrative Science: "Wall Street is high on Wells Fargo, expecting it to report earnings that are up 15.7 percent from a year ago when it reports its second quarter earnings on Friday, July 13, 2012," said the article on Forbes.com. While computers cannot parse the subtleties of each story, they can take vast amounts of raw data and turn it into what passes for news, analysts say.

"This can work for anything that is basic and formulaic," says Ken Doctor, an analyst with the media research firm Outsell. And with media companies under intense financial pressure, the move to automate some news production "does speak directly to the rebuilding of the cost economics of journalism," said Doctor. Stephen Doig, a journalism professor at Arizona State University who has used computer systems to sift through data which is then provided to reporters, said the new computer-generated writing is a logical next step. Read more >>

Monday, July 9, 2012

Wall Street Employees Lose $2 Billion in Their 401(k)s

Wall Street employees, who dispense financial advice to individuals and companies, aren’t following a basic investing tenet with their own money: diversification. Workers at the five largest Wall Street banks saw the value of company stock in their 401(k) accounts, sometimes the biggest holding of those plans, decline more than $2 billion last year, according to annual filings. Those losses don’t include shares received as bonuses.

The 2001 collapse of Enron Corp. led to warnings that tying retirement funds to an employer’s stock could be more crippling when a company fails, resulting in the loss of both a nest egg as well as a source of income. Traders and bankers felt the pain of last year’s decline in revenue from job cuts and lower bonuses in addition to the shrinking of their 401(k) accounts.

“You’re already relying on that company for your job, your income, benefits and everything else,” said Chris Baker, co- founder of Carmel, Indiana-based Oaktree Financial Advisors Inc., which manages $100 million and primarily advises employees of drugmaker Eli Lilly & Co. “It’s not just another stock. It can magnify the impact on your personal finances if your portfolio takes a beating and your employer isn’t doing well.” Read more >>

The 2001 collapse of Enron Corp. led to warnings that tying retirement funds to an employer’s stock could be more crippling when a company fails, resulting in the loss of both a nest egg as well as a source of income. Traders and bankers felt the pain of last year’s decline in revenue from job cuts and lower bonuses in addition to the shrinking of their 401(k) accounts.

“You’re already relying on that company for your job, your income, benefits and everything else,” said Chris Baker, co- founder of Carmel, Indiana-based Oaktree Financial Advisors Inc., which manages $100 million and primarily advises employees of drugmaker Eli Lilly & Co. “It’s not just another stock. It can magnify the impact on your personal finances if your portfolio takes a beating and your employer isn’t doing well.” Read more >>

Labels:

$2 billion,

401(k),

Business,

Enron,

Financial adviser,

Indiana,

Investing,

Wall Street

Wednesday, June 6, 2012

Home Rentals — The New American Dream

Steve and Jodi Jacobson bought their Phoenix-area "dream home" in 2005.

They built flagstone steps to the front door. They tiled the kitchen and

bathroom. They entertained often, enjoying their mountain views.

"We put our soul into that house," says Steve Jacobson, 37. Then,

home prices tanked more than 50%. Steve, a software quality assurance

engineer, suffered pay cuts. In 2010, foreclosure claimed the home and

their $100,000 down payment. The Jacobsons

didn't lose their desire to live in a single-family home, however. They

now rent one, like many other former homeowners displaced by

foreclosure.

But unlike traditional apartment renters, this breed of American tenants are older and have kids, U.S. Census Bureau

data indicate. As they move from homes they owned to ones they rent,

they're changing neighborhoods for better and for worse. They're fueling

a land-rush as investors snap up homes, mostly in markets hard-hit by

foreclosure, to rent to them. And their growth — in cities from Florida

to California — has implications for home builders, school districts and

companies that will jockey for the dollars they used to invest in

homes, predict Wall Street analysts and demographic researchers. Read more >>

Wednesday, May 30, 2012

"Inside Job" Director: Wall Street Has Turned the U.S. into a "Predatory Nation"

Two years after directing the Academy Award-winning documentary, “Inside Job,” filmmaker Charles Ferguson returns with a new book, “Predator Nation: Corporate Criminals, Political Corruption, and the Hijacking of America.”

Ferguson explores why no top financial executives have been jailed for their role in the nation’s worst economic crisis since the Great Depression. We also discuss Larry Summers and the revolving door between academia and Wall Street, as well as the key role Democrats have played in deregulating the financial industry.

According to Ferguson, a "predatory elite" has "taken over significant portions of economic policy and of the political system, and also, unfortunately, major portions of the economics discipline. Read more >>

Saturday, May 19, 2012

Biggest Weekly Loss For S&P Since November 2011

The world’s richest people lost a combined $32.8 billion this week as concerns over a possible Greek exit from the euro area pushed the Standard &Poor’s 500 index to its biggest weekly loss since November 2011.

Mexican Carlos Slim, 72, lost the most during the week, as shares of his Mexico City-based telecommunications company America Movil SAB fell 4.38 percent. Slim, who lost $4.1 billion, remains the world’s richest person with a $65.5 billion fortune, according to the Bloomberg Billionaires Index.

The S&P 500 fell 4.3 percent to 1295.22 during the week as Greece failed to form a government and Moody’s Investors Service downgraded 16 Spanish banks, citing a recession and mounting loan losses. The S&P 500 is down almost 9 percent since April 2. More...

Mexican Carlos Slim, 72, lost the most during the week, as shares of his Mexico City-based telecommunications company America Movil SAB fell 4.38 percent. Slim, who lost $4.1 billion, remains the world’s richest person with a $65.5 billion fortune, according to the Bloomberg Billionaires Index.

The S&P 500 fell 4.3 percent to 1295.22 during the week as Greece failed to form a government and Moody’s Investors Service downgraded 16 Spanish banks, citing a recession and mounting loan losses. The S&P 500 is down almost 9 percent since April 2. More...

Labels:

Barack Obama,

Carlos Slim,

Greece,

Mexico City,

Moody,

Spanish Banks,

Standard Poor,

Wall Street

Subscribe to:

Posts (Atom)