Wednesday, September 4, 2013

Why Amazon Is on a Warehouse Building Spree

(It’s announced five more in the U.S. this year.) Amazon aims to be able to deliver most items the day they’re ordered, so it can keep rivals such as EBay (EBAY) and Wal-Mart Stores (WMT) from peeling off customers. EBay offers same-day delivery in some cities, and Wal-Mart is moving more sales online.

“What Wal-Mart and EBay are working on is, can they be faster than Amazon?” says Wells Fargo (WFC) analyst Matt Nemer. “It might not be the highest-margin sale in the world, but they can potentially get something to you in an hour.”

Amazon introduced its expedited-shipping program, Prime, in 2005. Prime offers two-day service for $79 a year, plus $3.99 or more per order for same-day or one-day delivery; non-Prime Amazon customers pay $8.99 and up for same-day delivery. But Amazon can’t guarantee top speed for most items or locations. Read more >>

Monday, July 8, 2013

Temporary jobs becoming a permanent fixture

From Wal-Mart to General Motors to PepsiCo, companies are increasingly turning to temps and to a much larger universe of freelancers, contract workers and consultants. Combined, these workers number nearly 17 million people who have only tenuous ties to the companies that pay them — about 12% of everyone with a job.

Hiring is always healthy for an economy. Yet the rise in temp and contract work shows that many employers aren't willing to hire for the long run.

The number of temps has jumped more than 50% since the recession ended four years ago to nearly 2.7 million — the most on government records dating to 1990. In no other sector has hiring come close.

Driving the trend are lingering uncertainty about the economy and employers' desire for more flexibility in matching their payrolls to their revenue. Some employers have also sought to sidestep the new health care law's rule that they provide medical coverage for permanent workers. Last week, though, the Obama administration delayed that provision of the law for a year. Read more >>

Wednesday, March 27, 2013

Customers Flee Wal-Mart Empty Shelves for Target, Costco

During recent visits, the retired accountant from Newark, Delaware, says she failed to find more than a dozen basic items, including certain types of face cream, cold medicine, bandages, mouthwash, hangers, lamps and fabrics.

The cosmetics section “looked like someone raided it,” said Hancock, 63.

Wal-Mart’s loss was a gain for Kohl’s Corp. (KSS), Safeway Inc. (SWY), Target Corp. (TGT) and Walgreen Co. (WAG) -- the chains Hancock hit for the items she couldn’t find at Wal-Mart.

“If it’s not on the shelf, I can’t buy it,” she said. “You hate to see a company self-destruct, but there are other places to go.”

It’s not as though the merchandise isn’t there. It’s piling up in aisles and in the back of stores because Wal-Mart doesn’t have enough bodies to restock the shelves, according to interviews with store workers. In the past five years, the world’s largest retailer added 455 U.S. Wal-Mart stores, a 13 percent increase, according to filings and the company’s website. In the same period, its total U.S. workforce, which includes Sam’s Club employees, dropped by about 20,000, or 1.4 percent. Wal-Mart employs about 1.4 million U.S. workers. Read more >>

Thursday, February 21, 2013

Wal-Mart: "Families Are Adjusting To A Reduced Paycheck And Increased Gas Prices"

Here is the key section:

"We are confident that our low prices will continue to resonate, as families adjust to a reduced paycheck and increased gas prices," Simon said. "We see the underlying health of the Walmart U.S. business is sound, and sales trends are similar to what we've demonstrated in the last few quarters. However, February sales started slower than planned, due in large part, to the delay in income tax refunds. We began seeing increased tax refund check activity late last week in our stores, resulting in a more normalized weekly sales pattern for this time of the year. Due to the slower sales rate in the first few weeks of this year's first quarter, we are forecasting comp sales for the 13-week period from Jan. 26 to Apr. 26, 2013 to be around flat. We continue to monitor economic conditions that can impact our sales, such as rising fuel prices, changes in inflation and the payroll tax increase." Read more >>

Wednesday, October 10, 2012

Wal-Mart Labor Protests Grow

Protests against Wal-Mart expanded on Tuesday, spreading to 28 stores in 12 states, a union spokesman said. In an effort to increase pressure on the retailer as the holiday season approaches, 88 employees at the stores missed work, the spokesman, Dan Schlademan, said.

Mr. Schlademan, director of the union-backed Making Change at Walmart campaign, added that more than 200 employees were traveling to Wal-Mart’s headquarters in Bentonville, Ark., to stage a protest on Wednesday during the company’s annual meeting with financial analysts.

Grundig Compact Shortwave AM/FM Radio Black (Google Affiliate Ad)

He warned that disgruntled Wal-Mart employees, joined by labor unions and community groups, might stage a combined protest and educational campaign the Friday after Thanksgiving, the traditional start of the holiday shopping season.

Mr. Schlademan said the 88 employees who missed work on Tuesday were engaged in a strike that followed what union officials said was a strike by 63 Los Angeles-area Walmart workers last Thursday. They called that the first strike ever in Wal-Mart’s 50-year history. Read more >>

Tuesday, December 27, 2011

Holiday returns to hit record $46 billion

Image via WikipediaThe holidays aren't even over yet and shoppers are racking up returns already. Whether it's the wrong size, wrong style or just plain weird, shoppers will return $46.28 billion in holiday merchandise, a record high, according to the National Retail Federation.

Image via WikipediaThe holidays aren't even over yet and shoppers are racking up returns already. Whether it's the wrong size, wrong style or just plain weird, shoppers will return $46.28 billion in holiday merchandise, a record high, according to the National Retail Federation.This year, shoppers are bringing items back even before those presents are wrapped or bows are tied. That's partly a result of record-breaking sales on Black Friday and Cyber Monday, when buyers flocked to stores like Target, Wal-Mart and Best Buy.

"Higher sales will bring higher return amounts," said Kathy Grannis, a spokeswoman for the NRF. Some gift buyers are bringing purchases back now to take advantage of additional markdowns retailers are making in the days before Christmas, explained Candace Corlett of WSL Strategic Retail, a New York-based consulting firm. More...

Tuesday, November 29, 2011

Waiting for midnight, hungry families on food stamps give Walmart 'enormous spike'

Image via WikipediaAt the stroke of midnight, a growing number of Americans are lining up at Walmart not to cash in on a holiday sale, but because they’re hungry. The increasing number of Americans relying on food stamps to survive the sluggish economic recovery has changed the way the largest retailer in the United States does business.

Image via WikipediaAt the stroke of midnight, a growing number of Americans are lining up at Walmart not to cash in on a holiday sale, but because they’re hungry. The increasing number of Americans relying on food stamps to survive the sluggish economic recovery has changed the way the largest retailer in the United States does business.Carol Johnston, Walmart’s senior vice president of store development, said that store managers have seen an “enormous spike” in the number of consumers shopping at midnight on the first of the month. That’s typically when those receiving federal food assistance have their accounts refilled each month.

“We’ll bring in more staff to stock. We’ll also make sure all of our registers…are open…Some people may think at 12:01, Walmart’s very quiet, but in a lot of our areas of the country, 12:01 is a big day or a big night for us, actually,” Johnston said. More...

Friday, October 14, 2011

Utah to make gold legal currency

Image via WikipediaThe US state of Utah has passed a Bill that legalizes gold and silver for everyday financial transactions. Press TV talks with David Morgan, Silver Investor.com from Washington who was a party to the signing of this declaration to allow people to use gold and silver as transactional money for their everyday living expenses. He explains how this would be done. Following is an approximate transcript of the interview.

Image via WikipediaThe US state of Utah has passed a Bill that legalizes gold and silver for everyday financial transactions. Press TV talks with David Morgan, Silver Investor.com from Washington who was a party to the signing of this declaration to allow people to use gold and silver as transactional money for their everyday living expenses. He explains how this would be done. Following is an approximate transcript of the interview.Press TV: There's a huge global insurrection against banker occupation and underneath that we see some interesting cross currents going on as well. You've just returned from the Utah monetary conference where you signed the Utah monetary declaration. How exciting - tell us all about it?

David Morgan: Utah is the first state in the union that has at law passed the fact that citizens can voluntarily transaction in the state in commerce. So in other words simply stated you can buy and sell with gold and silver as a transaction basis throughout the state.

Now, that is a little tough to do coin-wise so they've implemented a strategy that I think is very simple and one that we're familiar with - Put your gold and your silver with a depository; the bank gives you a credit on their balance sheet; they issue you with a debit card; and then you just use the debit card.

So to the merchants, Wal-Mart as an example, you simply swipe your debit card, the transaction goes down to the spot price that day whatever the spot price for gold or silver is and then at the end of the month they reconcile the account based on what you purchased during the month.

Once this is implemented I think it's going to catch on and then of course it sets a standard I think for other states to come along and do the same thing. There are 11 states that have proposed gold and silver in transactions, but Utah is the only one that has passed it in the law so far.

Press TV: If you have your account based in gold and silver and you're using it as your go-to savings account and checking account, you have protection against the government printing up lots of fiat-dollars and inflating the purchasing value away from your currency - so why wouldn't anyone not want to do this?

David Morgan: I do believe it's going to catch on - it's hard to say; there's a argument about Gresham's law that good money chases out bad - that you're only going to save the good money. But I don't think this is necessarily true and I don't have time to go into all the arguments, but I interviewed Larry Hilton who wrote the bill - he's a lawyer in Utah - and basically there's lots of reasons why you would want to use physical gold and silver in a transaction. More...

Friday, September 16, 2011

Food inflation is far worse in grocery stores than restaurants

Image by Getty Images via @daylifeAccording to the latest government figures, the consumer price index for food at home increased by 60 basis points year-over-year to 6% versus the 10 basis point gain in food away from home CPI inflation to 2.7%.

Image by Getty Images via @daylifeAccording to the latest government figures, the consumer price index for food at home increased by 60 basis points year-over-year to 6% versus the 10 basis point gain in food away from home CPI inflation to 2.7%.Food inflation is now the most important household expense, according to Wal-Mart's (WMT) commentary during its earnings call last month. Food prices, according to the Bureau of Labor Statistics, continue to accelerate higher. The charts below illustrate food cost trends and food cost trends versus core inflation. It's worth noting that the spread between food at home inflation and core inflation widened month-over-month while the spread between food away from home and core inflation narrowed. More...

Wednesday, May 18, 2011

With $4 Gas, More Folks Skip the Trip to Wal-Mart and Lowe's

Image via WikipediaAmericans living paycheck to paycheck are looking at the gas gauge before they run their errands, and that's hurting big retail chains such as Wal-Mart Stores Inc. and Lowe's Cos.

Image via WikipediaAmericans living paycheck to paycheck are looking at the gas gauge before they run their errands, and that's hurting big retail chains such as Wal-Mart Stores Inc. and Lowe's Cos."Our customers are consolidating trips due to higher gas prices," said Wal-Mart U.S. head Bill Simon during the retailer's earnings conference call Tuesday. "One in five Wal-Mart moms list gasoline as a top expense behind housing and car payments."

Reflecting those concerns about the cost of driving, customer visits to Wal-Mart are down—and that's hurting sales. More...

Monday, March 7, 2011

Our economic death spiral into the Second Great Depression

- Debt monetization (printing money out of thin air to cover the portion of governments spending not satisfied by tax revenue and borrowing) reduces the value of the dollar.

- The debt monetization triggers dollars to flow out of bonds and into commodities.

- This increases demand, commodity prices rise.

- As commodities make their way into the supply chains businesses and consumers realize higher prices.

- Since globalization has caused wages to stagnate at 1970 levels, and with 23% unemployment, businesses try to eat increases, this in turn reduces hiring, causes layoffs and kills expansion.

- Consumers reduce their purchases, case in point: Wal-Mart is losing market share to the Dollar Store - that right there spells retail health (read: it’s terminal).

- Nations whose citizens spend 32%-52% of their entire budget on food are especially affected.

- In those nations where citizens spend 32%-52% of total their income on food; food riots erupt, social unrest breaks out, governments topple.

- Geographically speaking, many of these nations are in the Middle East where about a third of the world's oil supply comes from - so oil production is adversely affected, the price of oil increases. Drastically increases. The empire must then send in troops and warships to protect oil assets from being wiped off the map.

- Oil is an integral part of everything from farming to manufacturing to transportation, therfore the prices of all goods and services rise.

- This of course creates more stress on our economy, which drives tax revenues down, whic creates a greater deficit, which causes idtiot Ben to lean on the print button and monetize even more debt.

- Like an infinite loop in some errant computer code we go back to #1 above and iterate back through this unstoppable, self reinforcing, negatively-insane-Ben Bernanke-code that we call a negative self reinforcing feedback loop. More...http://unveilingtheeconomy.blogspot.com/2011/03/guest-post-bernankes-unstoppable-self.html

Wednesday, January 19, 2011

America's 50 Most Powerful People in Food

Thursday, September 23, 2010

Forget a Recession, The Empire is Crumbling

Image via WikipediaPhoenix Capital Research

Image via WikipediaPhoenix Capital ResearchI look around me and I see an Empire in Decline.

The US economy is clearly in a depression… not a recession, not a recovery, but a DEPRESSION. More than 40 million Americans (12%) are on Food stamps. Nearly one in five of us are unemployed of underemployed. Folks go to Wal-Mart at 11PM waiting for their government checks to clear at midnight so they can buy baby formula, milk and other necessities.

Three out of every five Americans are overweight. One in five are obese. Indeed, there are only two areas (one state, Colorado, and Washington DC) where obesity rates are under 20%.

Nearly three in four of us don’t get enough sleep. Almost one third of us report having trouble falling asleep EVERY night. And almost half of us report that day-time sleepiness interferes with normal activities including work.

Half of marriages end in divorce. One out of ten married couples report sleeping alone. The average American watches 28 hours of TV a week (enough to qualify for a part-time job). Two thirds of us eat dinner while watching TV, preferring the fake, sensationalized lives of others to engaging with our own families.

The TV and media are filled with foul, ungodly images of sex, violence, and hate. The most watched shows of the last decade all feature ordinary folks becoming superstars in lottery-esque competitions (American Idol, Survivor, Who Wants to be a Millionaire, etc) OR crime sagas detailing the most sordid and disgusting elements of society (CSI, Law and Order, etc) OR amoral social dramas in which notions of personal responsibility, fidelity, and common decency are unknown (Desperate Housewives, the Bachelorette, etc).

Today, brain dead, vapid human beings who have contributed nothing to society are idolized and followed as though they invented the wheel. We’ve actually got two industries devoted to presenting the illusion and reality of celebrity: Hollywood shows the photo-shopped, CGI-enhanced, scripted version, while the paparazzi and weekly glossies reveal the drug-addicted, affair-crazed, family breaking, soul-less emptiness.

Sex or violence are plastered on virtually every flat surface available. Even the check-out lines at the grocery store feature endless images of barely clothed women along with headlines sensationalizing gruesome behavior, right out in the open for children to see. And if the kid can actually read the headlines… God only knows what ideas this stuff is putting into their heads.

Financially, we’re all pretty much bust or going bust (except those on Wall Street).

New home sales in July were a RECORD low. Not record as in for the year, but the lowest since 1963. The talking heads are high fiving because sales improved in August, but failed to note that they were still DOWN 19% from August 2009 levels.

Americans two primary assets for retirement (stocks and their homes) have both been absolute disasters. Home prices are down 30%, stocks haven’t produced gains in over a decade. Every moron on TV talks about the Dow 10,000 like it’s a miracle. But when you adjust the Dow for inflation, (using the BLS’ ridiculous CPI measure) the Dow is SUB-500 in terms of purchasing power.

Our money system is controlled by an elite banking oligarchy fronted by academics who have never run a business, invented anything, or had any interaction with commerce aside from vying for tenure. Our currency is now worth less than 1/20th of what it was a century ago. And we are ALL in debt up to our eyeballs on a personal, corporate, local, state, and federal level. More...

Wednesday, September 22, 2010

Watching Wal-Mart at Midnight

Image via Wikipedia

Image via WikipediaThis comment from Wal-Mart Stores Inc. has been making the rounds on blogs and newswires the past few days. It says it all about the state of the tepid U.S. recovery. The Journal’s Al Lewis wrote about it yesterday.

Bill Simon, CEO of Wal-Mart’s U.S. business, at a Goldman Sachs conference last week, on behavior at a Walmart store around midnight at the end of a month:

“The paycheck cycle we’ve talked about before remains extreme. It is our responsibility to figure out how to sell in that environment, adjusting pack sizes, large pack at sizes the beginning of the month, small pack sizes at the end of the month. And to figure out how to deal with what is an ever-increasing amount of transactions being paid for with government assistance.

“And you need not go further than one of our stores on midnight at the end of the month. And it’s real interesting to watch, about 11 p.m., customers start to come in and shop, fill their grocery basket with basic items, baby formula, milk, bread, eggs,and continue to shop and mill about the store until midnight, when electronic — government electronic benefits cards get activated and then the checkout starts and occurs. And our sales for those first few hours on the first of the month are substantially and significantly higher.

“And if you really think about it, the only reason somebody gets out in the middle of the night and buys baby formula is that they need it, and they’ve been waiting for it. Otherwise, we are open 24 hours — come at 5 a.m., come at 7 a.m., come at 10 a.m. But if you are there at midnight, you are there for a reason.”

Monday, May 17, 2010

Sears, Kmart, accepting Gold jewelry

Image by Getty Images via Daylife

Image by Getty Images via Daylife

Sears Holdings Corp, which expanded its layaway program to help cash-strapped consumers pay for purchases during the recession, is now helping its customers exchange their jewelry for cash as gold prices soar.

The new service, available at the jewelry departments of Sears and Kmart stores, allows customers to send their gold and silver items to Pro Gold Network, a company that buys precious metals from consumers.

Pro Gold makes an offer on the gold or silver and the consumer can choose to accept the offer or have the items returned, free of charge, Sears said.

Sears provides the shipping envelop and also helps consumers track the items via websites or a toll-free customer service number.

Sears has seen sales pressured over the past two years by the weak economy and has also lost sales to discounters like Wal-Mart Stores Inc (WMT.N) and electronics retailers like Best Buy Co Inc (BBY.N). The company did say, however, that sales improved in the first quarter.

In 2008, it expanded its layaway program as a way to help cash-strapped consumers pay for goods.

Advertising from companies offering gold recycling services had reached a fever pitch in late 2008 due to a global economic crisis, as the price of gold climbed above $1,000 an ounce in a flight to safety.

Last week, gold has soared to record highs at just below $1,250 an ounce as jittery investors fretted over sovereign risks and inflation.

Bullion is still far away from its inflation-adjusted record at over $2,200, analysts said. In 2001, gold was trading at just $250 an ounce.

Source

Saturday, November 21, 2009

The Day The Dollar Died

Image via Wikipedia

Image via Wikipedia

The following story is a potential fictional time line for the day the dollar died. I hope not to instill fear or loathing but to give everyone some perspective on a POSSIBLE outcome which does not really take much of a reach to come to any conclusion. Despite popular belief and promises from those who wish to rob you of your savings and investments, the collapse of the dollar might just be an event measured in hours, not days as their control is not what it seems….

Mike was less than an hour from home in Minnesota after dropping his load off in Fargo but knew he needed to top his tank off this Sunday evening to insure his rig would make it home. He pulled into the Petro Truck Stop just outside of Fargo and hopped out of the cab into the bitter twenty below temperatures which he could not believe had already hit at ten o’clock at night. He slid his fuel card into the pump waiting for the next prompt when the “SEE ATTENDANT” message flashed in the screen. He blustered, figured it was another card problem and whipped out his Master Card and slid it in after the pump reset and again the “SEE ATTENDANT” message flashed up. “What the hell is going on?” he thought to himself as he wandered into the long line of drivers boisterously yelling at managers and clerks alike.

Tom finished up his shift on the docks at the Nestle warehouse in Hampton, Georgia at exactly 11 o’clock at night and decided that because of the scuttlebutt he had been reading on the message boards, it may not be a bad idea to pick up a few cans of food and some toilet paper at the local WalMart Super center. Even though it was a Sunday night, they were always stocked and it was just five minutes out of the way to his home. As he walked inside the store, his mouth dropped. It looked like the day after Thanksgiving sale with every register open and ten plus people deep at 11:30 p.m. “Oh my God!” he gasped as he walked in grabbing the last shopping cart with the wheel that was half locked up. As he walked as fast as he could to the aisle with the paper goods, he looked at all the shelves then noticed the clerk who looked stunned himself. “How in the SAM HELL does WalMart sell out of Toilet Paper son?” he screamed at the eighteen year old kid. “Sir, I don’t know what is going on. Is the world ending? I’m a little freaked out!” the clerk stammered. Tom realized that he was not to blame and as he calmed down said to the kid “Son, I don’t know what is going on either. It must be an ice storm on the way. Are you folks getting another truck soon?” The clerk said in a very low voice “Sir, I think there are two coming at 2 a.m. I would wait here if I were you.” With that information Tom slinked outside to his car and called his wife at home just before midnight to tell her he would be staying to wait on the WalMart trucks.

1730 ET…February 21, 2010

It was a typical Sunday night in my household, a tremendous dinner, nice weather in Florida and of course a chance to chat with my friends online about the events of the world. The big news was that on Friday, February 19, 2010 the US Dollar Index closed at 69.07 far below any level in history and of course shattering all known technical support. As I grabbed a glass of Port and settled in front of my computer at 5 p.m. Eastern to watch the Asian fireworks and watch Bloomberg and CNBC-Asia on my computer, I noticed the Middle Eastern markets closed in horrid shape. The Israeli market closed three hours after the open and down 22% for the session. The Saudi markets closed after one hour and down 41%. Other regional markets did not open or were shut down due to national emergency declarations. As I tuned in expecting the usual repeat on Bloomberg, it was live with a somewhat excited news babe reading information from a blog reporting “rumors” that the CEO’s of Citigroup and Bank of America were in meetings since 11 a.m. with the New York Fed. At that point, it was time to put the port up and break out the hard stuff. more...

Tuesday, November 17, 2009

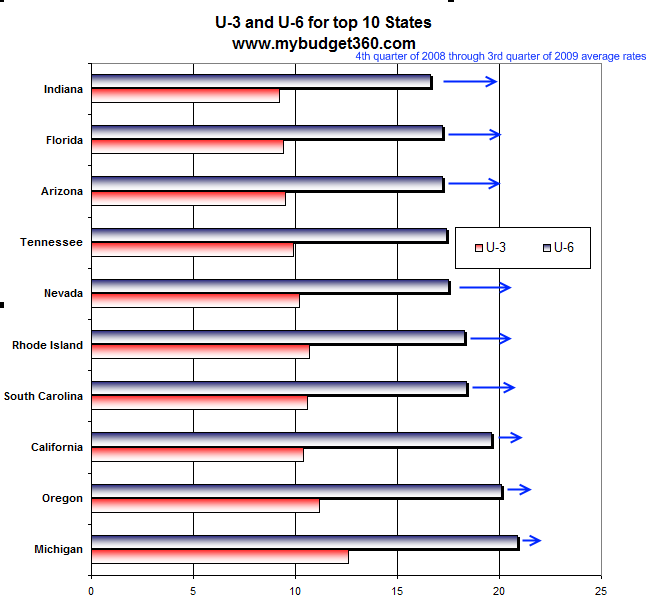

10 States with Underemployment Rates of 20+ Percent

The average American family must look at the current stock market rally as some kind of cruel joke. We have people anxiously waiting for government funds or paychecks to clear at the end of the month so they can wait outside of a Wal-Mart shopping center at midnight to buy food once their funds clear. We have nearly 36 million Americans on food stamps and another 27 million unemployed or underemployed. If this is the new recovery, many want very little to do with it.

It is hard to believe in this recovery because the bailout has gone to the financial sector and is reflected in hyper-inflated equity prices. As obvious as it seems, some people don’t make the connection that an unemployed American is a weaker consumer. Consumption as we all know is two-thirds of our economy. Therefore you would assume that investors would make this connection but that is not the case. The banks being the few with any sort of heavy government money, instead of lending to Americans, are once again gambling in the stock market casino. What a sad testimony to our crony capitalistic system that banks instead of believing in the average American, are deciding to double down on Wall Street and trying to recoup their 2008 losses. This on the pretense that banks needed money to get lending going again.

One thing that is clear is the employment situation is in a major funk. 10 states now have underemployment rates of over 20 percent. We are talking about Great Depression statistics here:

The above data is pulled from the Bureau of Labor and Statistics and is an average from the fourth quarter of 2008 to the end of the third quarter in 2009. In other words, the data above is optimistic and doesn’t use the latest data that is even higher. For example, California recently reported their U-6 rate is now up to 22 percent. Michigan? Their U-6 is now closer to 25 percent. There is nothing remotely close to a recovery in the data above. More...

Tuesday, October 6, 2009

The Obama Effect - Americans Hoard Ammo

Image by mr.smashy via

Image by mr.smashy via

Americans aren't just hoarding Ammo because they fear a Democratic crackdown on the 2nd Amendment. Americans clearly see that a total economic collapse in the U.S. is dead ahead.

Lewis Page

Ammo rationing at Wal-Mart as panic buying sweeps US

The USA is suffering the most severe ammunition famine in living memory. Gun fanciers, fearing a Democrat crackdown on every American's right to pack heat, are clearing shelves at ammo shops and hoarding cartridges.

AP reports that the Remington Arms Company's factory in North Carolina is now working around the clock trying to supply insatiable demand for rifle, pistol and shotgun cartridges.

"We've had to add a fourth shift and go 24-7," Remington spokesman Al Russo told the news wire. "It's a phenomenon that I have not seen before in my 30 years in the business."

The shortages are so bad that retail globocorp Wal-Mart has been forced to introduce rationing at the ammo counter in many of its stores. Depending on calibre, customers may be limited to purchases of just 50 rounds at a time. Apparently, classic .45 ACP pistol ammunition is especially scarce - a fairly good indication that it is in fact conservative Middle America rather than, say, inner-city criminals buying up all the ammo*.

According to the National Rifle Association, America's pro-guns lobby, the people of the USA normally buy about 7 billion cartridges a year (an average of 23 rounds per head). The past year has seen that figure jump to 9 billion. The FBI reports a 25 per cent climb in background checks made prior to gun sales.

The ammo rush has been dubbed the "Obama effect" by gun-industry people, but in fact there is no sign at present of any particularly aggressive move towards stricter federal gun laws.

Tuesday, July 21, 2009

After The Collapse Stores Will Accept Gold and Silver

A good friend of mine sent me this enlightening video regarding grocery stores accepting silver in California. Many financial analysts and bloggers have devoted hours of their time in endless deflation versus inflation debates -- as if it matters, either way ultimately hyperinflation will result; nevertheless, the devaluation of U.S. currency will occur and may be caused in a variety of ways: a bank holiday, collapse of the dollar, or an accepted basket of currencies replacing the dollar as the new world reserve currency.

Food will be more valuable than gold and silver in the beginning stages of the collapse where unorganized chaos will prevail. During a bank holiday, ATMs may be inoperable, and huge retail outlets like Walmart will only accept cash; their minimum wage cashiers wouldn't have a clue what to do with gold or silver coins. But in time, as this video demonstrates, major retail stores will employ trained gold and silver conversion technicians who will -- based on the daily price of gold and silver -- tabulate the value of your precious metal in exchange for goods and services.